-

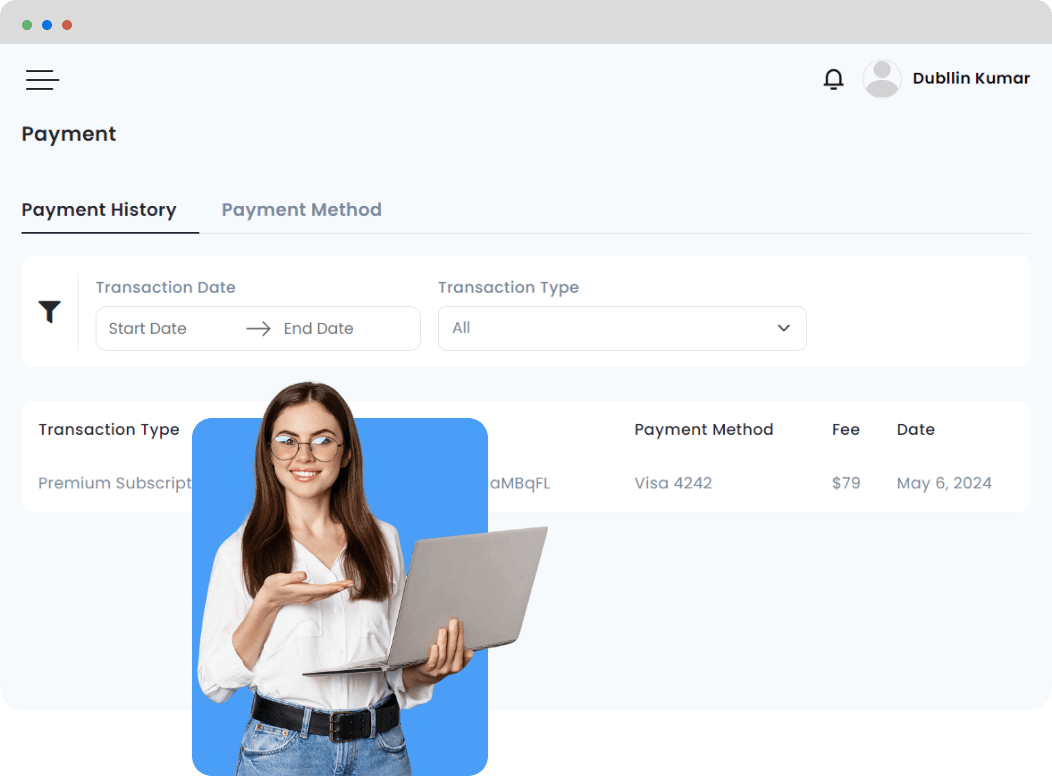

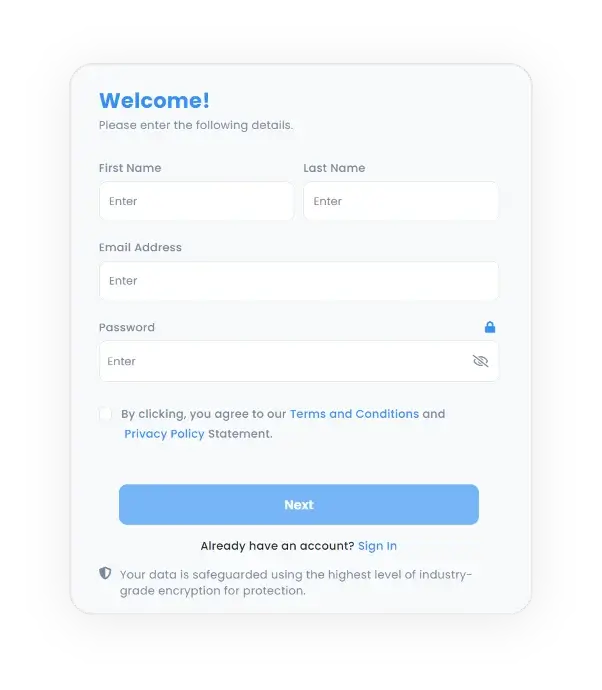

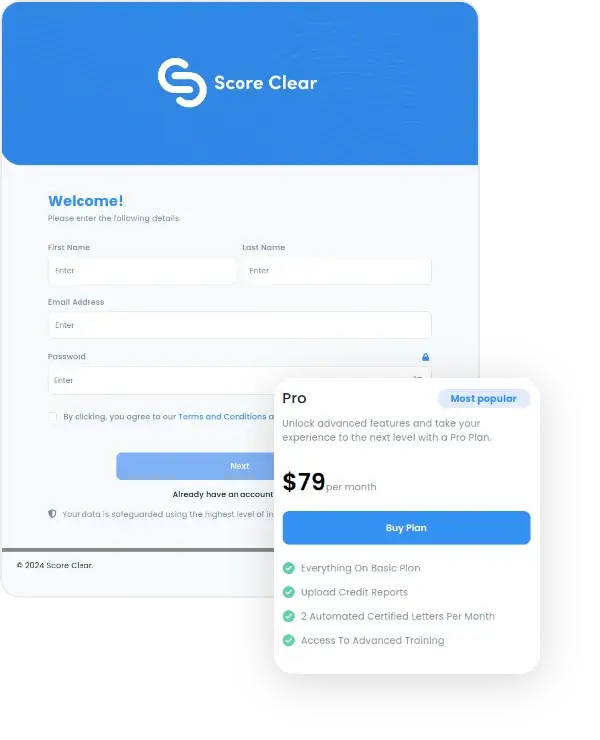

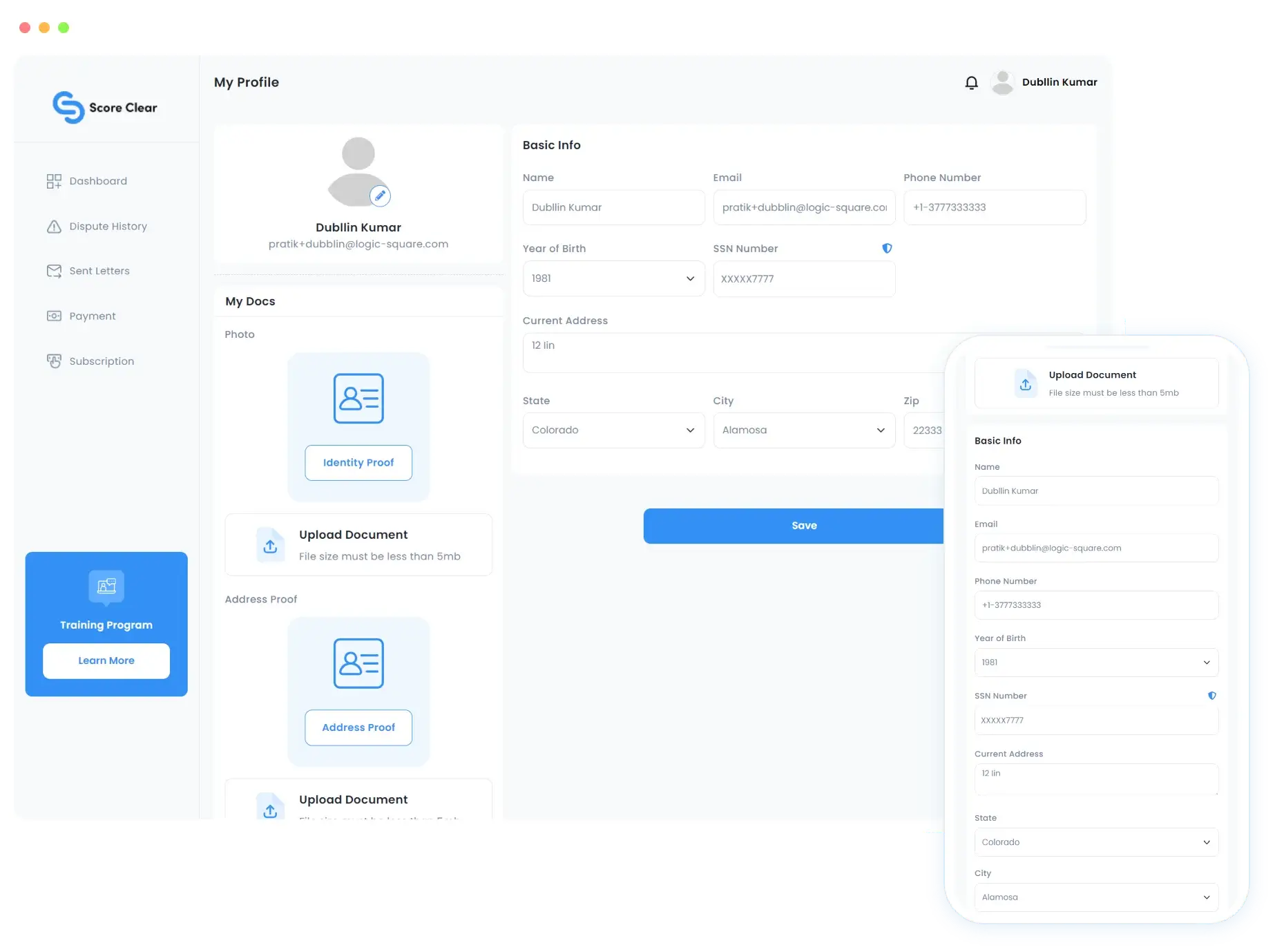

Profile Creation With Subscription Plans

The app allows users to create profiles and choose from Basic, Pro, and Elite plans, tailoring the Credit Revive experience to their needs and preferences.

-

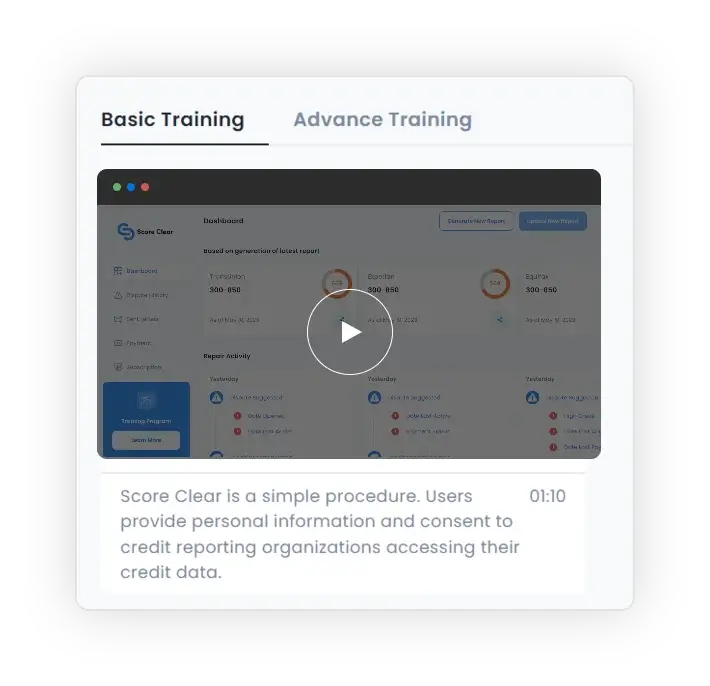

Tailored Users Training

Credit Revive empowers users with a targeted training curriculum and guidance, depending on their chosen subscription plan.

-

Two-Way Verification

The app offers users a robust two-way verification process, ensuring a secure and authenticated sign-up and report generation each time and safeguarding user-profiles and privacy.

-

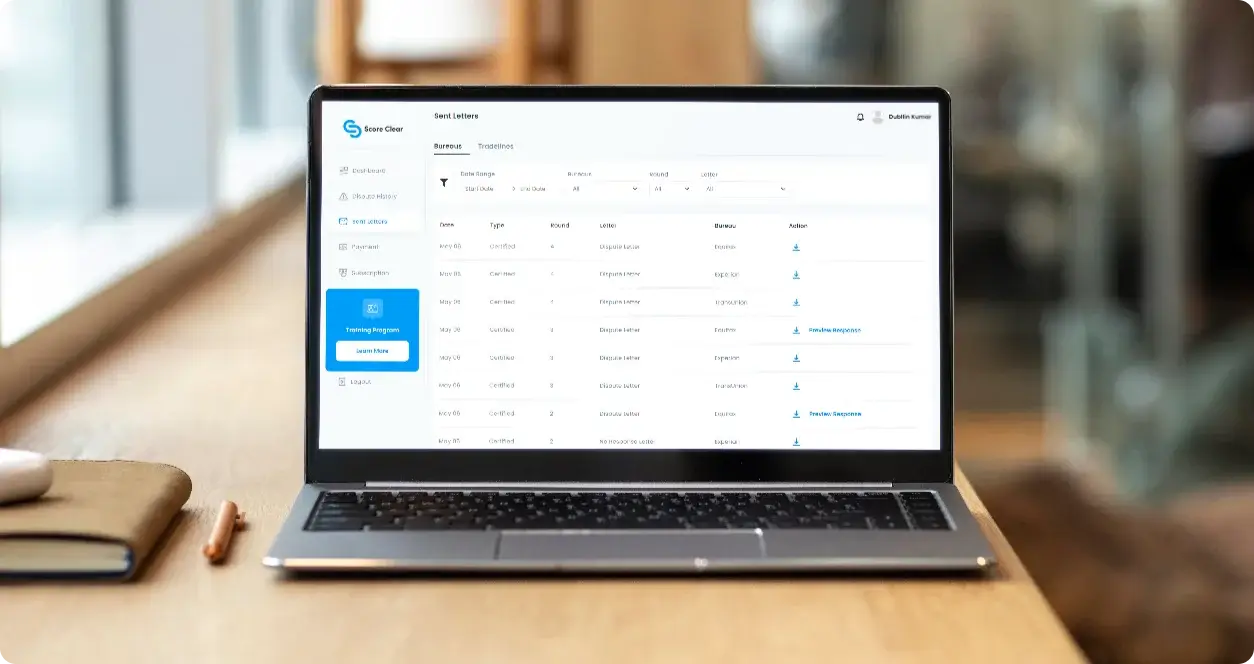

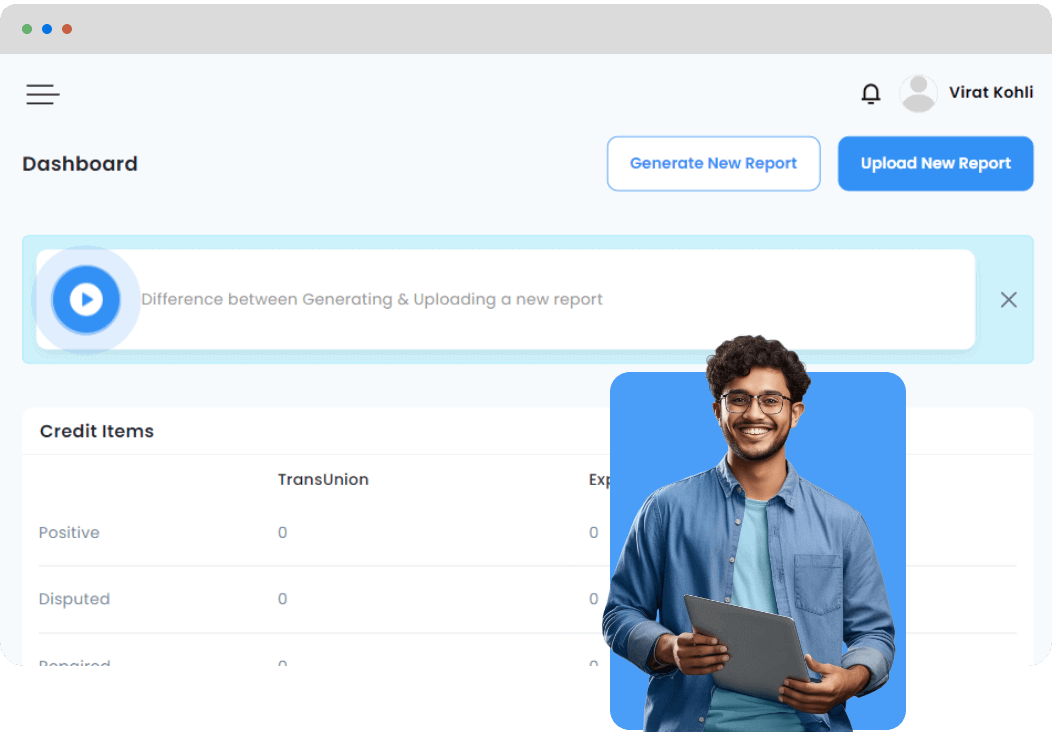

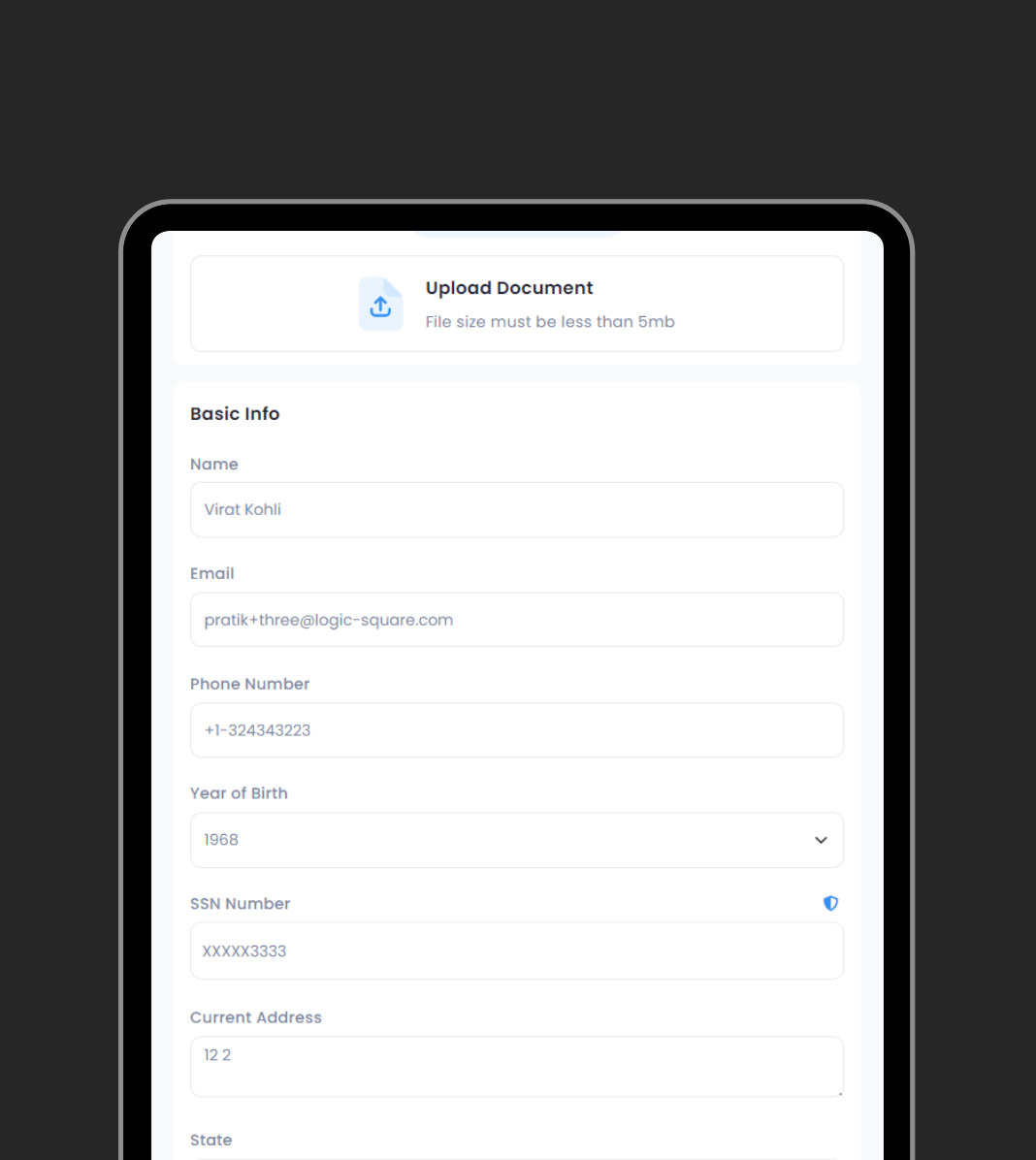

Streamlined Document Management & Upload

With the help of this app, users can effortlessly upload and manage essential documents such as credit reports, driver's licenses, and utility bills in various PDF formats.

-

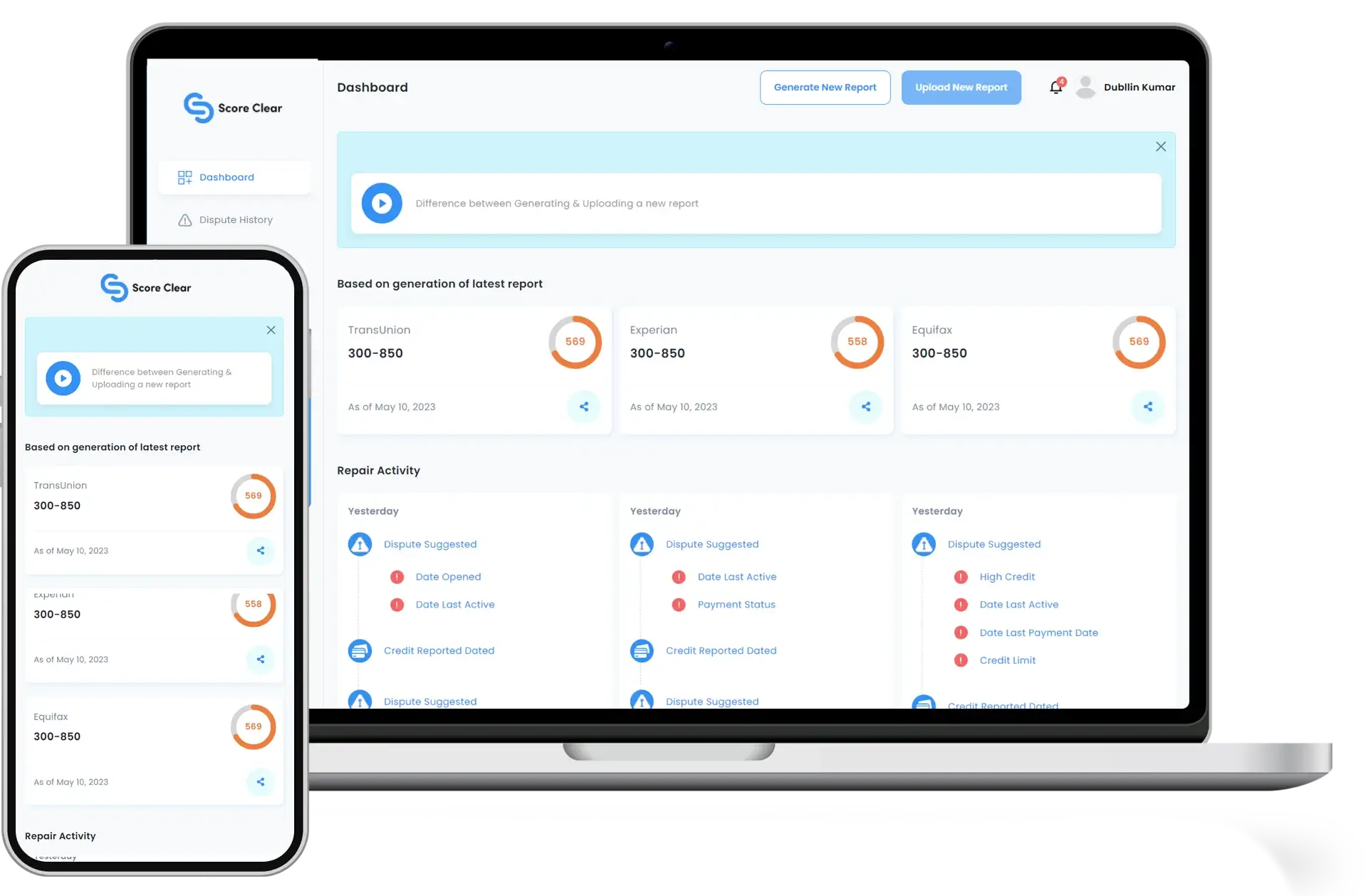

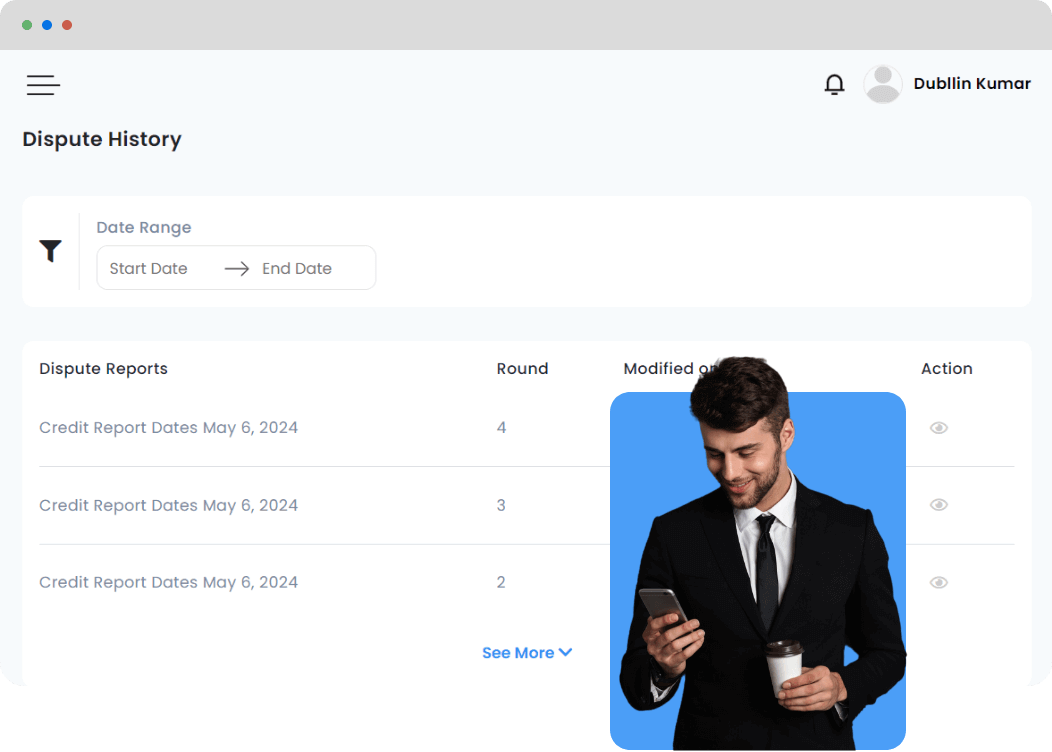

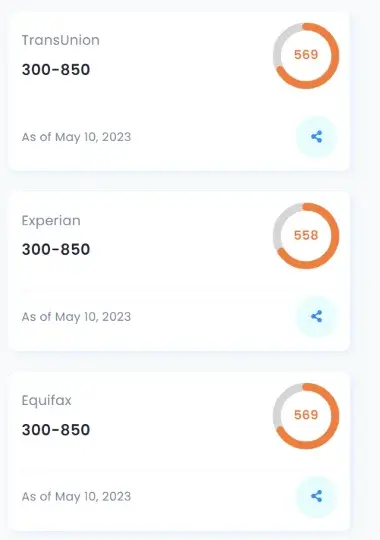

Automated Credit Report Generation

Credit Revive uses the CRS API to generate accurate and detailed credit reports, giving users a comprehensive view of their financial standing.

-

AI-powered Dispute Detection and Analysis

It leverages OpenAI API for intelligent dispute detection and analysis, enhancing accuracy and efficiency when dealing with credit bureaus and trade-lines.