Financial Services/Fintech

Insurance & Mutual Fund Distributor

Webapp Development

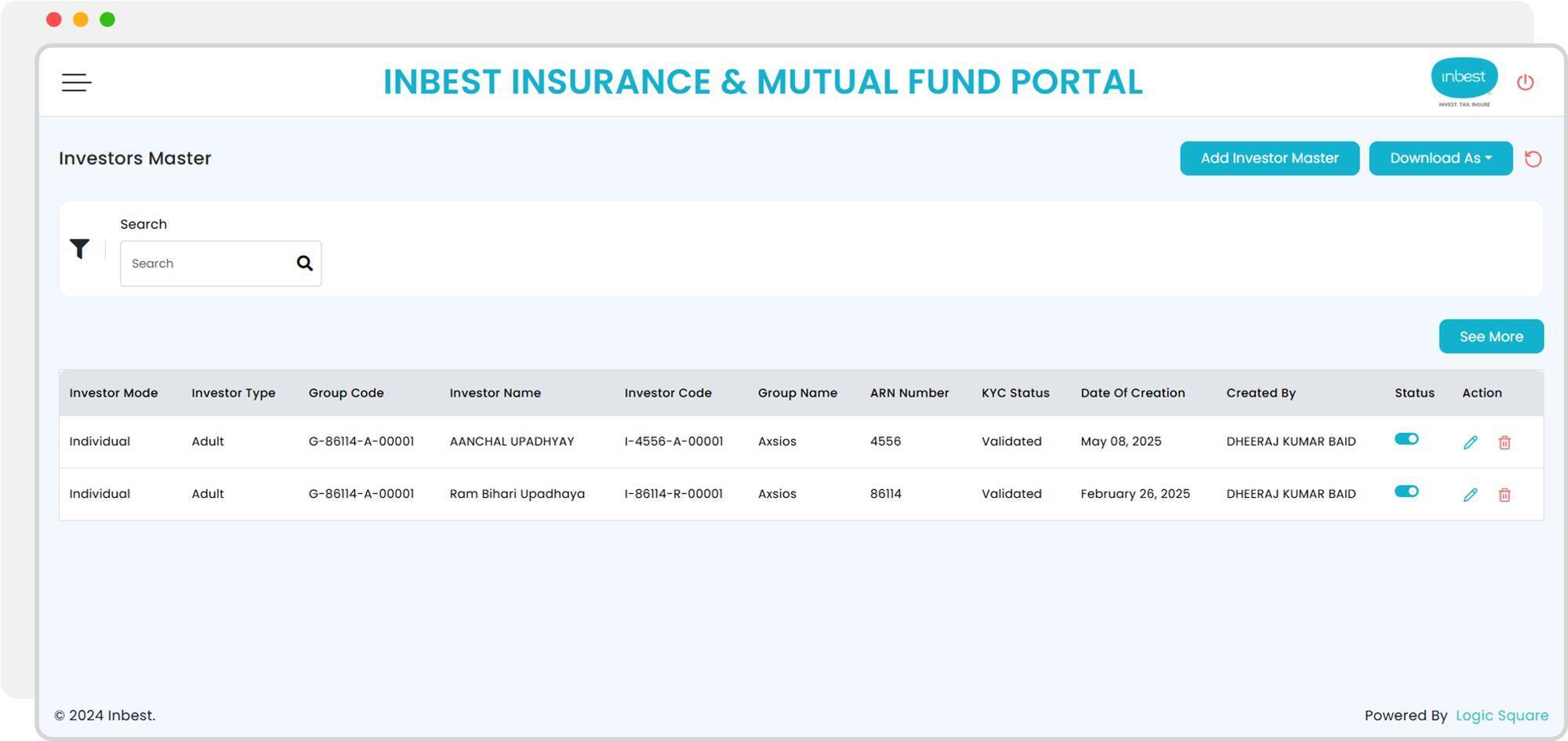

Inbest is a multi-registrar financial reporting platform that builds tools for intermediaries managing complex investor groups, including minors, corporates, and joint holders. They offer tools to manage investor portfolios, process transactions, and ensure compliance across financial products.

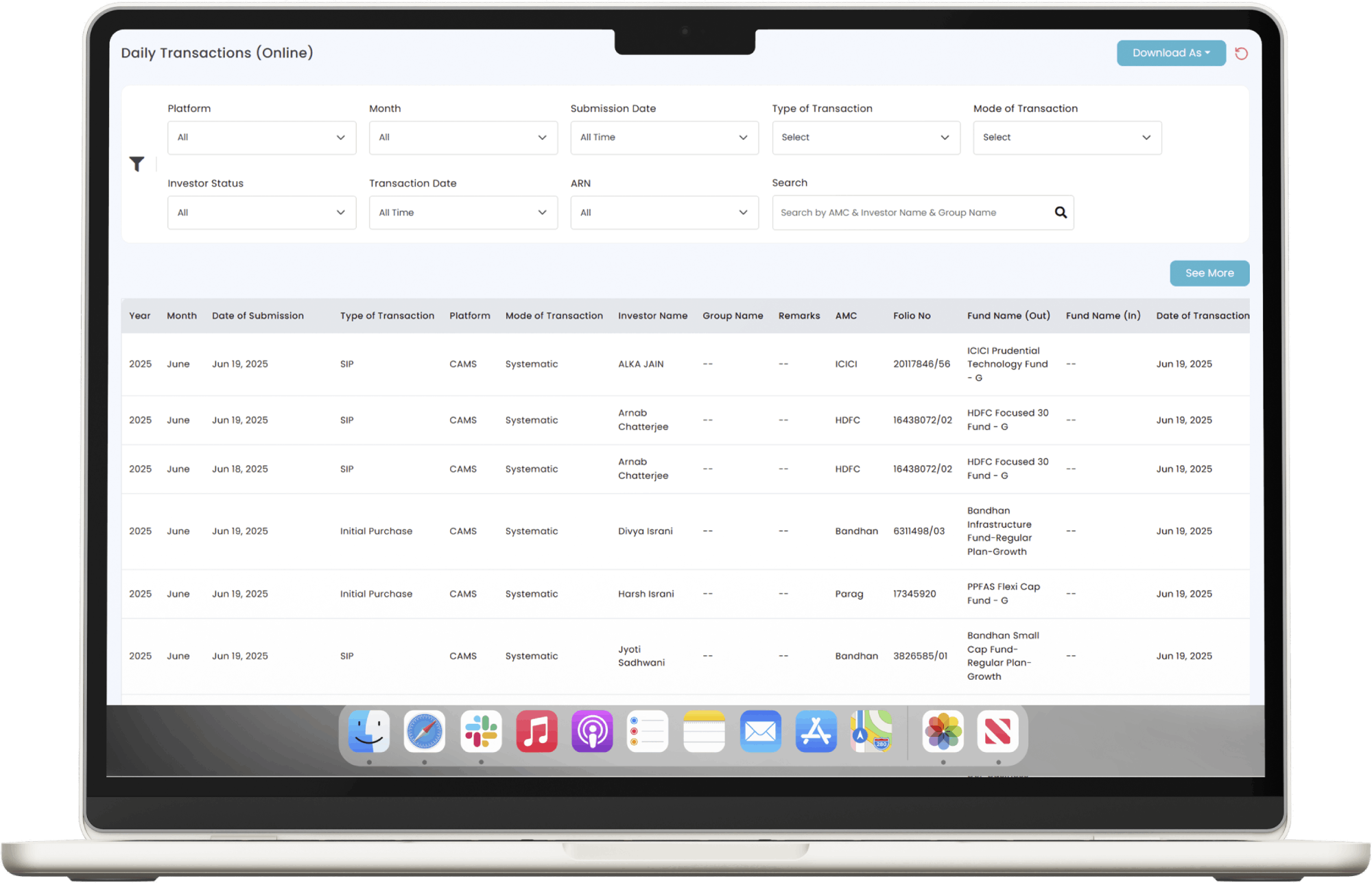

The platform supports high-volume SIP, STP, and SWP transactions daily, providing standardized tracking and reporting to ensure accuracy and efficiency in handling intricate investor hierarchies.

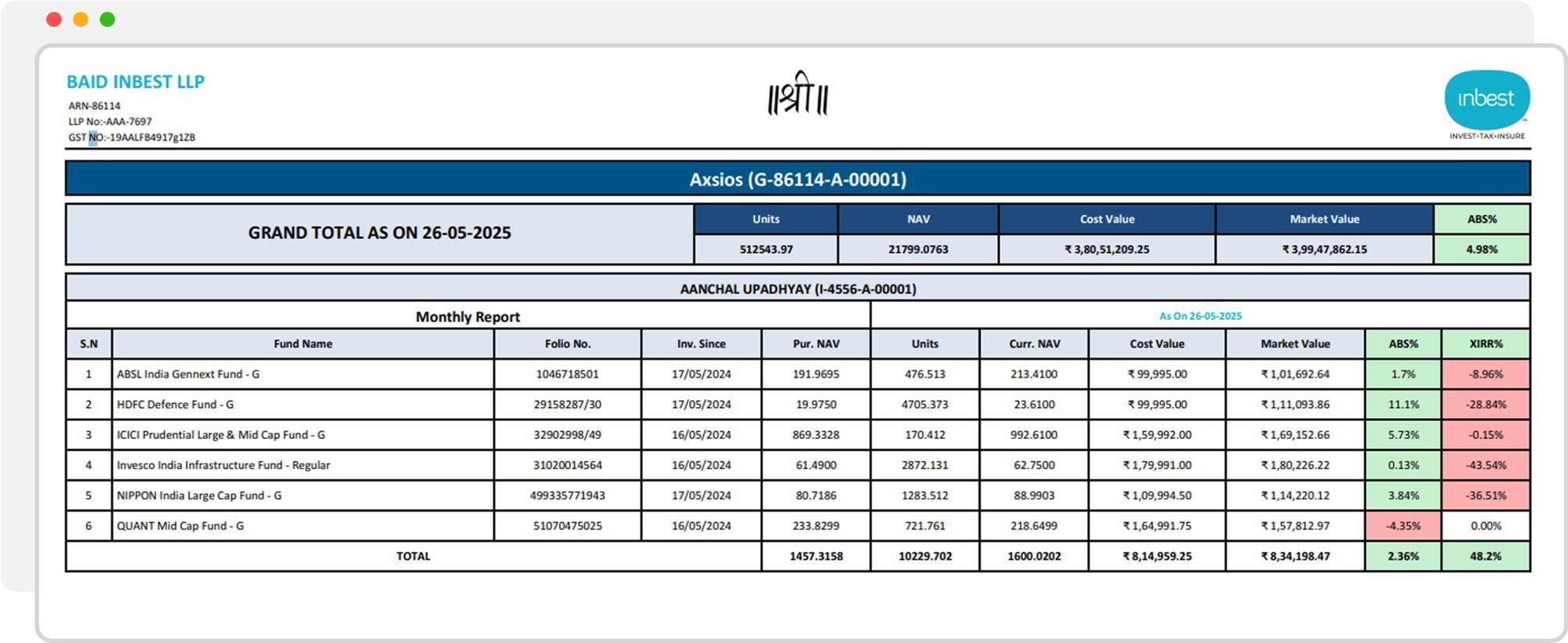

Inbest is a custom-built back-office solution designed for financial distributors and advisors to seamlessly manage investor transactions, portfolios, reporting, and compliance. As part of its expansion, Inbest introduced a Mutual Fund Investment module featuring a powerful SIP transaction engine and a comprehensive reporting dashboard. This unified solution empowers investment professionals to track investor activities, ensure regulatory compliance, generate detailed reports, and analyze portfolios — all through a single intuitive interface.

This MVP serves as the foundation for future development, paving the way for investor-facing dashboards and advanced automation layers.

The key objectives of the project were focused on creating a robust, scalable, and user-centric solution for financial intermediaries:

During the project, the team tackled several complex challenges to ensure the platform could deliver accuracy, compliance, and scalability:

The biggest challenge was normalizing multi-format data received from various registrars, each with its structure and inconsistencies.

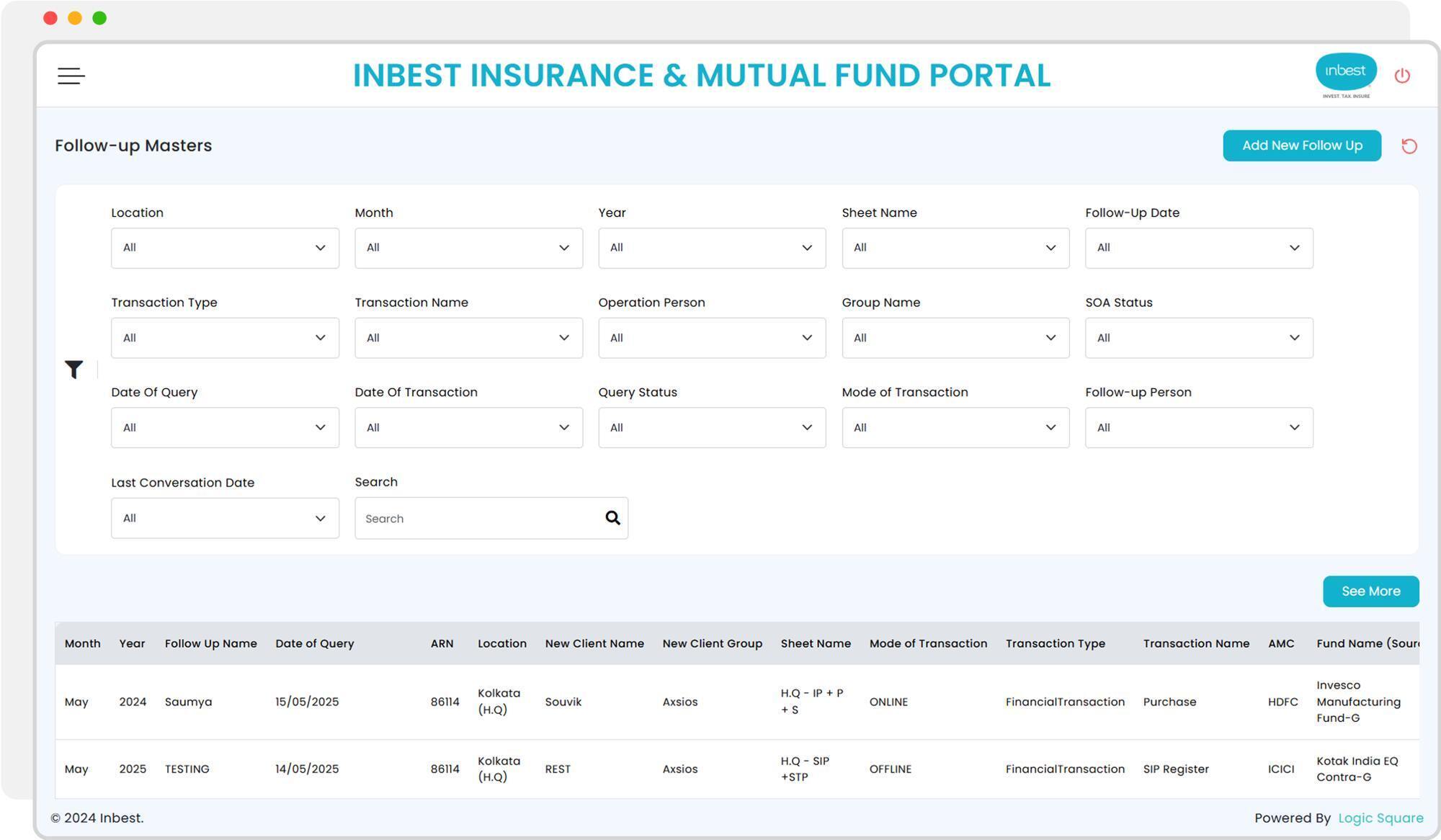

Managing interlinked transactions (such as STP-IN and STP-OUT) requires precise handling to flag errors without compromising data integrity.

Ensuring robust compliance checks (PAN, Aadhaar, bank proof) for diverse and complex investor types, including Minors, HUFs, LLPs, and Corporates, was critical.

Building a manual entry system that balanced flexibility with structured processes to minimize human errors while accommodating exceptions.

We implemented secure authentication with Aadhaar-linked logins and layered error handling to manage disabled or inactive users, invalid entries, and system-generated feedback for enhanced security and user control.

Transaction reporting was structured into three clear categories for better accuracy and usability:

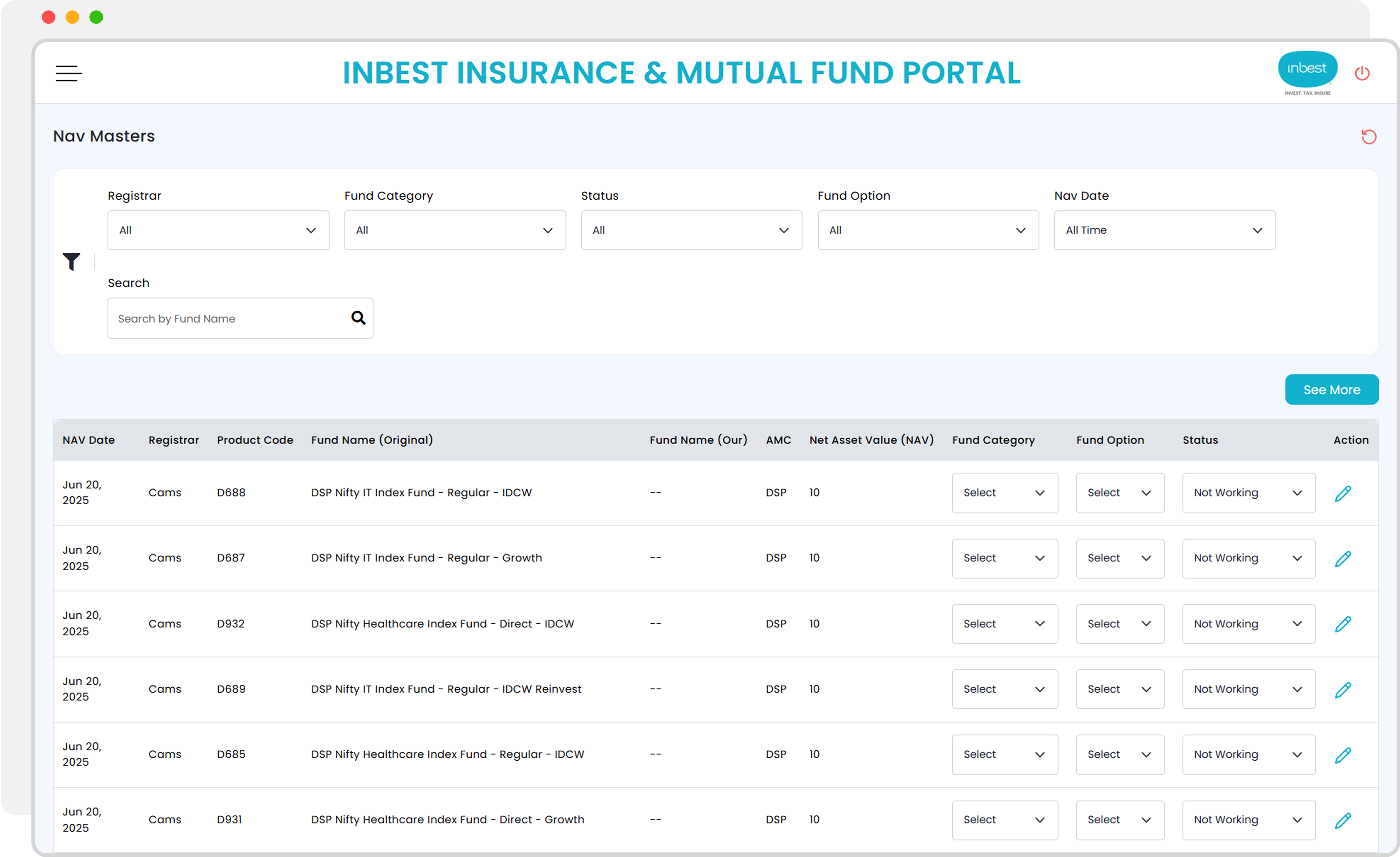

It standardizes registrar data using merged views from WBR1 and MFSD 217, and displays all NAVs with date, fund details, fund type and fund names(product codes). It also has option breakdown for portfolio analysis, making the performance calculation easy.

Once selected, users are informed they can get loans up to ₹10 Lakhs, based on eligibility.

Inbest provides a robust document and profile management system designed to handle investor compliance. It supports validation for minors (T-18 rule), and enables seamless multi-account tracking across portfolios.

Investors can be grouped under sophisticated structures such as LLPs, Trusts, and Companies, with full edit history and document traceability to ensure transparency.

Inbest manages investors through two structured modules:

Contact us today to discuss your project and see how we can help you bring it to life!

Smart flag detection, leveraging suffix and registrar nature mapping, significantly reduced the time required to classify transactions accurately.

Auto-population of key form fields during both entry and edit processes helped minimize manual errors and improved data accuracy.

The platform supports comprehensive document uploads for each holder and nominee, strengthening compliance and simplifying KYC and audit processes.

Advanced cost logic and monthly export options enabled audit-ready, group-level performance reports, giving users clear, reliable insights into their portfolios.

Eliminated data duplication and inconsistencies across 3 years, creating a reliable single source of truth.

Real-time NAV and accurate portfolio summaries made investment decisions quicker and more informed.

MVP features set the foundation for future modules like goal-based planning, SIP optimization, and tax harvesting.

All MVP features were successfully delivered with full modularity, ensuring flexibility for future enhancements and scalability.

The platform is now well-positioned and technically ready to support upcoming expansions, including: